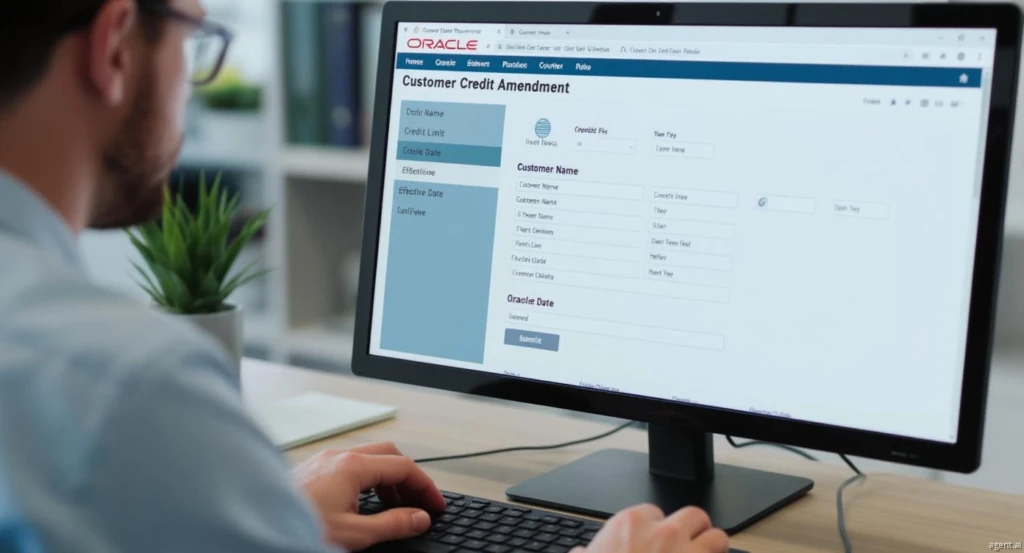

Customer Credit Amendment with Oracle EBS Integration

Digital transformation of the customer credit amendment process using SharePoint, enabling online submission, approval, and automated credit updates in Oracle EBS ERP.

Client Overview

A UAE-based property management company managing commercial and residential properties across multiple emirates.

Technical Stack

Industry

Real Estate

Region

UAE (Abu Dhabi, Dubai, Sharjah, Ras Al Khaimah)

Project-size

Non-Disclosable

Company size

Large scale company

Implementation Highlights

Auto-population of customer data from Oracle; end-to-end approval workflow; automated update of credit limits and payment terms in ERP; support for complex customer branch and bank structures.

Challenges & Solutions

Manual credit amendment requests led to delays, data inconsistencies, and compliance risks.

Solution: Implemented a SharePoint and Nintex-based digital workflow tightly integrated with Oracle EBS to ensure accuracy and controlled updates.

1000+ Projects Experienced

Access Iqra Technology’s skilled developers and experts. Enjoy a risk-free two-week trial and take advantage of our cost-effective solutions.

8+

Years of Business

Experience

100+

Happy

Customers

15+

Countries with

Happy Customers

100+

Agile enabled

employees

Results & Impact

- Reduced turnaround time for credit amendments, improved data accuracy, better compliance with ERP rules, and enhanced transparency across finance and

Key Learnings & Acheivement

- Managing complex ERP data structures requires strong validation and mapping; next steps include audit dashboards and automated alerts for credit limit breaches.

- The solution has been documented and maintained as a structured data library and reference framework, allowing other organizations to review, follow, and replicate the implementation approach. This positions the solution as a proven model, builds trust, and encourages prospective companies to engage with us.