Credit Notes

What is a Credit Note?

A Credit Note is a document issued by a seller to a buyer to acknowledge a return of goods, correction in an invoice, or refund due to overcharging. It reduces the amount that the customer owes.

Common Reasons for Issuing a Credit Note:

• Return of damaged or incorrect goods

• Overbilling or invoice correction

• Discounts or promotional refunds

• Canceled services

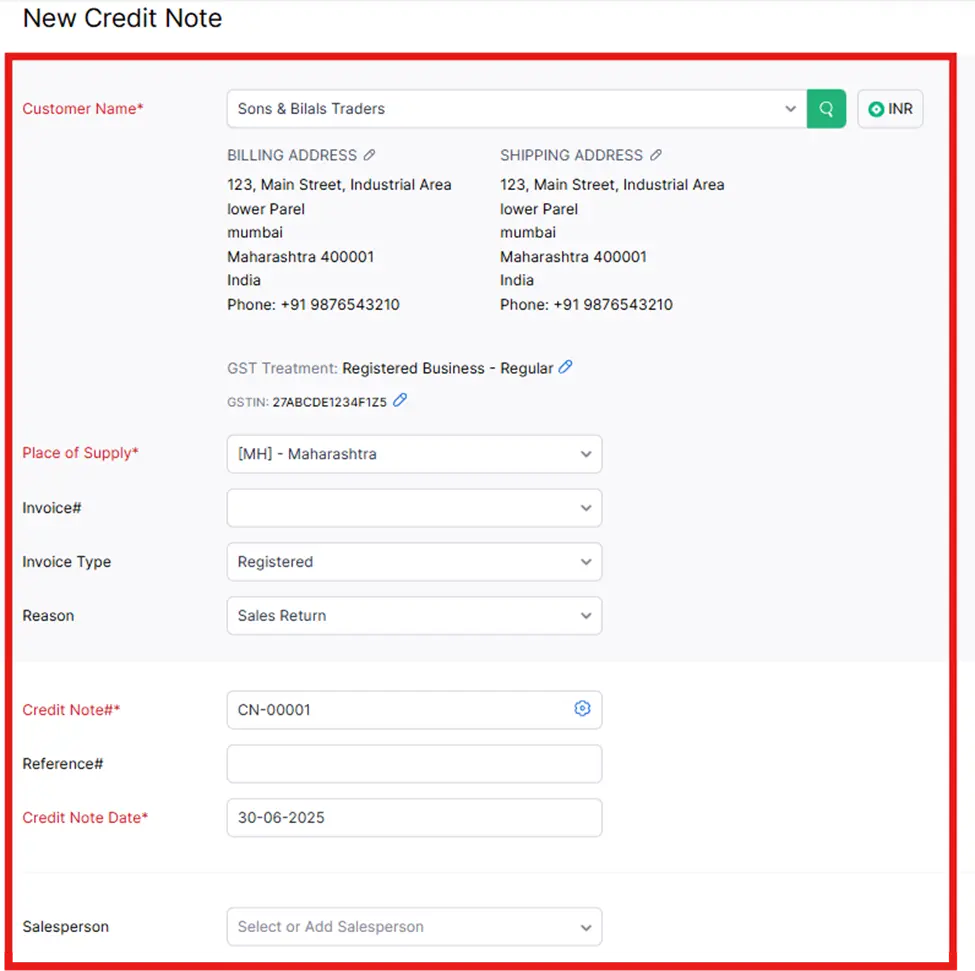

Here are the steps for creating a Recurring Invoices:

Step 1: Go to the “Sales” Module

Step 2: Under Sales, click “Credit Notes”.

Step 3: Click on “+ New Credit Note” A new credit note form will open (as shown in your screenshot).

Step 4: Click on the dropdown for Customer Name and choose an existing customer or add a new one.

Example: Sons & Bilals Traders

Step 5: Choose the reason for issuing the credit note from the dropdown options, such as “Return of Goods” “Discount Issued,” or “Invoice Correction.”

Note: The Credit Note Number will be auto-generated (e.g., CN-00001). You can also manually enter it if required. Add any necessary adjustments such as TDS or TCS in the subtotal section. Include relevant customer notes to be shown on the credit note, and specify terms & conditions that apply to this transaction. Lastly, configure email communication by adding the recipient’s email to send the credit note directly.

Step 6: Set the date of creation for the credit note (e.g., 26-06-2025).

Step 7: Optionally, you can link the credit note to an existing invoice or reference number.

Step 8: Under the Item Table, add items that are being credited. Enter details such as:

Account (e.g., Sales)

Quantity

Rate

Tax (e.g., GST18%)

Discount Amount

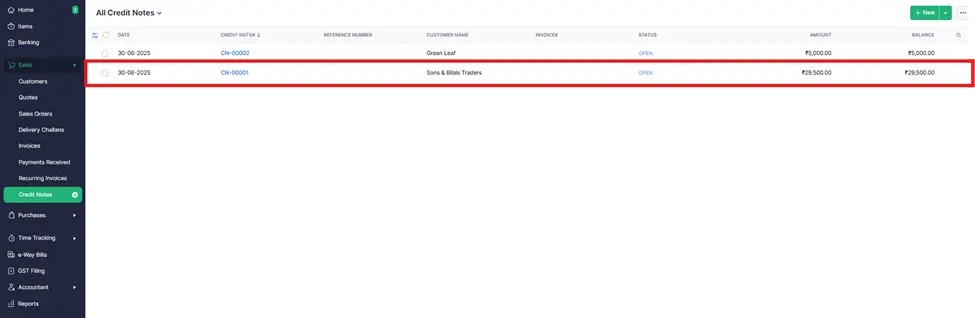

Step 9: After that click on the “Save as Open” button

You have now successfully completed the creation of the Credit Note, following the format displayed on the screen above.