Reconciliation

In Zoho Books, reconciliation is a process that ensures that the transactions recorded in Zoho Books match the transactions in your bank or credit card account. This helps to ensure that your financial records are accurate and consistent with your actual bank records. The goal of reconciliation is to spot any discrepancies, such as missing or incorrect entries, and to verify that everything is correct before finalizing the period.

Here’s a detailed breakdown of how reconciliation works in Zoho Books:

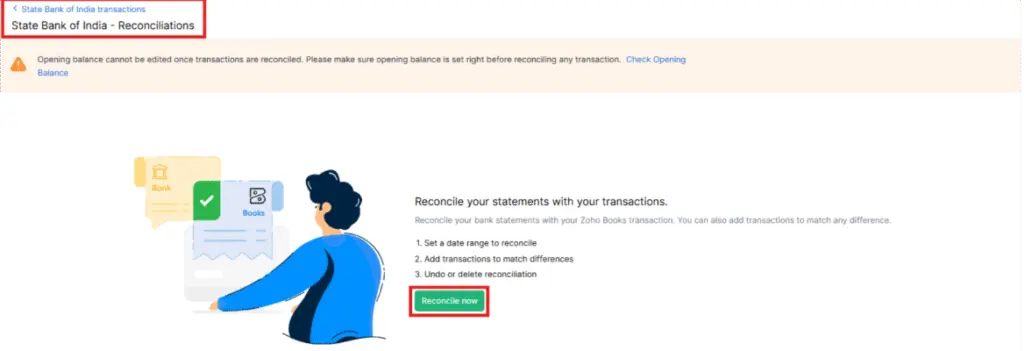

Note!!!: The opening balance cannot be edited once transactions have been reconciled. Please make sure the opening balance is accurate before reconciling any transactions.

You can reconcile your bank account in Zoho Books. Here’s how:

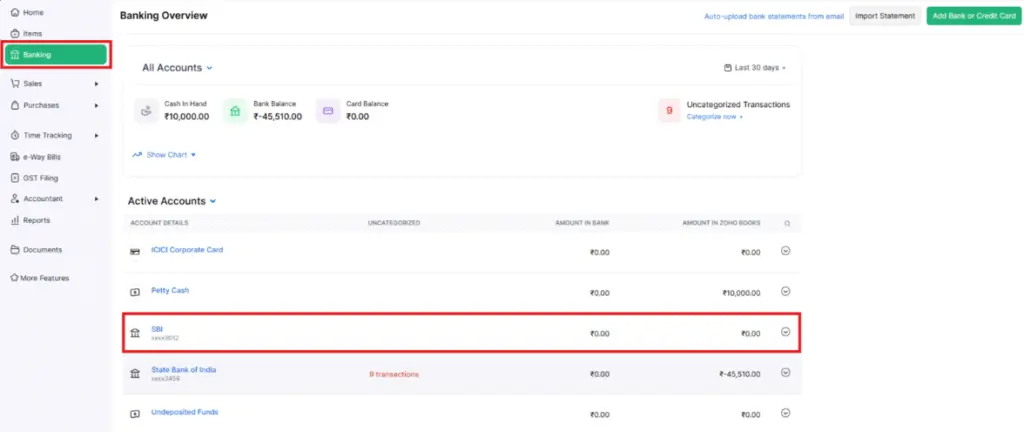

Step 1: Go to the Banking module in the left sidebar.

Step 2: Select the account for which you would like to reconcile transactions.

Step 3: Click the Gear icon in the top right corner of the page.

Step 4: Select Reconcile Account.

Click the Initiate Reconciliation button in the top right corner of the page.

Reconcile your statements with your transactions.

Reconcile your bank statements with your Zoho Books transaction. You can also add

transactions to match any difference.

1. Choose the Account to Reconcile

• You begin by selecting the bank account or credit card account that you want to reconcile. Zoho Books can link directly to your bank via a bank feed or you can manually import your bank statement.

• Bank Feed: Zoho Books allows you to connect your bank to import transactions automatically, which helps in the reconciliation process.

• Manual Upload: If your bank doesn’t support integration, you can manually upload the bank statement (in formats like CSV, QIF, or OFX).

2. Set the Period for Reconciliation

• You can reconcile the account for a specific period, such as:

- A monthly reconciliation, which is common for businesses.

- A custom period, like a quarter or specific date range

• This helps you compare the transactions between Zoho Books and your bank for that exact period to ensure accuracy.

3. Match Transactions

- Zoho Books will show you a list of transactions you have entered (like payments, sales invoices, purchases, etc.) and compare them with the transactions in your bank feed or uploaded statement.

- Your job is to match the transactions. If a transaction in Zoho Books appears in your bank statement, you mark it as matched.

- Example: If you received a payment, Zoho Books will show the payment in the “Sales Receipts” section, and you match it with the corresponding entry in the bank statement.

4. Add Missing Transactions

- Sometimes, your bank might have transactions that haven’t been entered in Zoho Books, like bank charges, interest, or refunds.

- If these transactions are missing, you can manually add them in Zoho Books to ensure everything is accounted for.

- Example: If your bank has a service charge that is not in Zoho Books, you can add it by creating an expense or bank fee entry.

5. Resolve Discrepancies

• Zoho Books will highlight any discrepancies that exist between the bank statement and your accounting records.

This report provides a comprehensive summary of all the profits and losses your business has incurred during a specific period. It also includes a summary of your operating and non-operating expenses.

To view this report:

Step 1: Go to Reports on the left sidebar.

Step 2: Navigate to Business Overview reports and select the Profit and Loss report from the list.

6. Finalize Reconciliation

- Once you’ve matched all transactions and resolved any discrepancies, you can finalize the reconciliation.

- When reconciliation is complete, Zoho Books will show a reconciliation report, which summarizes:

- The total reconciled amount.

- The unmatched transactions (if any).

- This gives you a clear overview of your account status.

7. Reconciliation Reports

• After completing the reconciliation, Zoho Books generates a reconciliation report that details all the transactions for the period.

• This report can be used for:

• Audit and tax preparation.

• Financial analysis to ensure accuracy.

• Business performance reviews to see if your cash flow is on track.

• The report will also show any discrepancies that were found during the process.

Why Reconciliation Is Important in Zoho Books

1.Accurate Financial Records: Ensures your books are accurate and reflect the real financial situation of your business.

2.Detect Errors and Fraud: Helps you catch mistakes and unauthorized transactions early.

3.Simplifies Tax Filing: Accurate reconciled accounts help ensure that your financial statements are correct for tax purposes.

4.Improves Cash Flow Management: By reconciling regularly, you get a better understanding of your business’s cash flow, allowing for better decision-making.

How to Reconcile in Zoho Books (Step-by-Step)

1. Go to the Banking Module: Navigate to the Banking section in Zoho Books and select the account you want to reconcile.

2. Select the Date Range: Choose the period (e.g., month or quarter) for which you want to reconcile.

3. Match Transactions: Compare and match the transactions from the bank statement with the ones you’ve entered in Zoho Books.

4. Resolve Discrepancies: Look for missing or incorrect transactions and correct them by adding or editing records in Zoho Books.

5. Finalize the Reconciliation: Once everything matches, finalize the reconciliation and generate the report.

Benefits of Reconciliation in Zoho Books

- Accuracy: Ensures all data is aligned with your bank’s records.

- Efficiency: The bank feed and automated matching features save time.

- Control: Helps you catch discrepancies and errors, giving you more control over your finances.

- Reporting: Zoho Books provides comprehensive reports, giving you a clear view of your account status.

Example: Monthly Bank Reconciliation

Let’s say you want to reconcile your bank account for the month of July:

1. Upload your bank statement for July in CSV or link to your bank account.

2. Zoho Books imports transactions and matches them with your entered data (e.g., payments received, bills paid).

3. If any transactions are missing, like bank fees, you manually add them.

4. Resolve any discrepancies like incorrect amounts or duplicate entries.

5. Once everything is matched, finalize the reconciliation.

6. You can generate a reconciliation report to check that everything is accurate.

In conclusion, reconciliation in Zoho Books is essential for ensuring the accuracy of your financial data by aligning your business records with your bank statements. Regular reconciliation helps maintain the integrity of your financial reports and keeps your business’s accounting on track