Zoho Books Introduction

1. What is Zoho Books?

Zoho Books is an easy-to-use, cloud-based accounting software that helps businesses manage their finances and stay on top of their cash flow. It is part of the Zoho suite and is designed for small to medium-sized businesses, freelancers, and even enterprises that require streamlined financial operations.

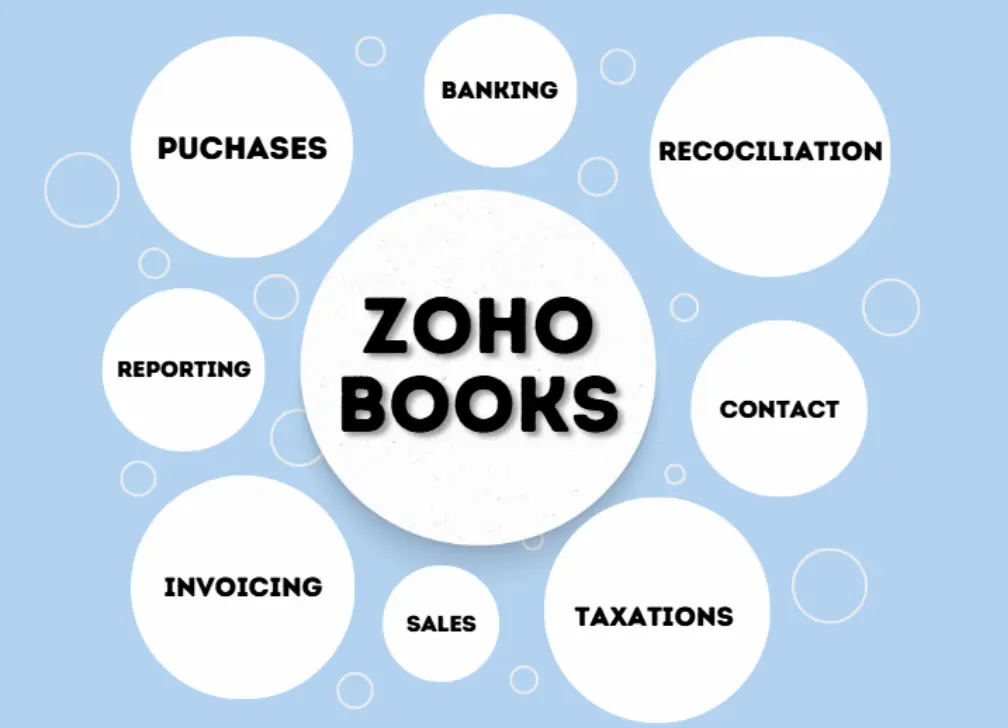

2. Key features of Zoho books:

• End-to-end accounting: Sales, purchases, banking, and reporting.

• GST/VAT-compliant invoicing and tax handling.

• Automation of recurring transactions.

• Seamless integration with payment gateways, banks, and other Zoho apps.

Real-time dashboard and insightful financial reports.

3. Why Use Zoho books?

Zoho Books stands out for its simplicity, affordability, and rich features. Here’s why it’s a preferred choice:

User-Friendly Interface: Clean layout, easy navigation, and no prior accounting knowledge required.

Automation Capabilities: Automates repetitive tasks like reminders, invoice generation, and payment tracking.

Cloud-Based Access: Access your financials anywhere, anytime, on any device.

Compliance Ready: Built-in support for tax regulations including GST in India, VAT in the UAE, and other international standards.

Scalability: Suitable for startups as well as growing companies

Collaboration: Easily collaborate with your accountant or team members by providing access control.

4. Zoho Books Interface Overview

Once logged in, you will see the following modules on the left panel:

• Dashboard: Gives you a snapshot of your financial health.

• Sales & Purchases: Manage invoices, customers, and vendor bills.

• Banking: Connect your bank account for auto-reconciliation.

• Reports: Generate profit & loss statements, balance sheets, and GST reports.

Settings: Customize your organization details, users, and tax preferences.