Reports

The Reports module in Zoho Books helps you monitor every aspect of your business by offering detailed reports on sales, purchases, inventory, accounting, taxes, and user activities. Before diving into the various types of reports, it’s important to understand how you can customize and manage these reports based on your business needs. One important category is the Business Overview Reports, which provide a snapshot of your company’s overall financial performance over a selected period. These reports include vital information such as total revenue, expenses, profits, and cash flow, helping you evaluate the financial health and growth of your business effectively.

Let us see the different types of reports in Zoho Books:

After following these steps, the Bank Account is successfully generated and shown on-screen above-mentioned image.

1. Business Overview

Profit and Loss

Cash flow Statement

Balance Sheet

2. Sales

Sales by Customer

Sales by Item

Sales by Salesperson

1. Business Overview

Business overview reports provide a comprehensive summary of a company’s performance and health over a specific period. These reports summarize the revenue, expenses, profits, and cash flow of an organization.

Let’s take a look at the various business overview reports you can generate to assess the financial health of your organization.

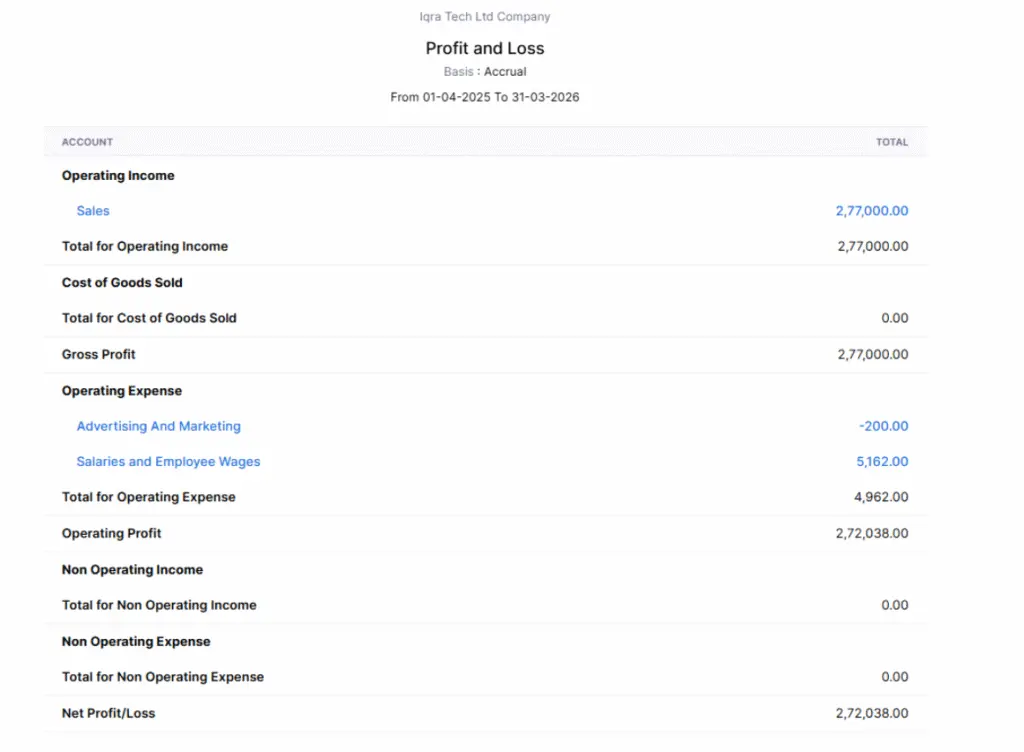

Profit and Loss

This report provides a comprehensive summary of all the profits and losses your business has incurred during a specific period. It also includes a summary of your operating and non-operating expenses.

To view this report:

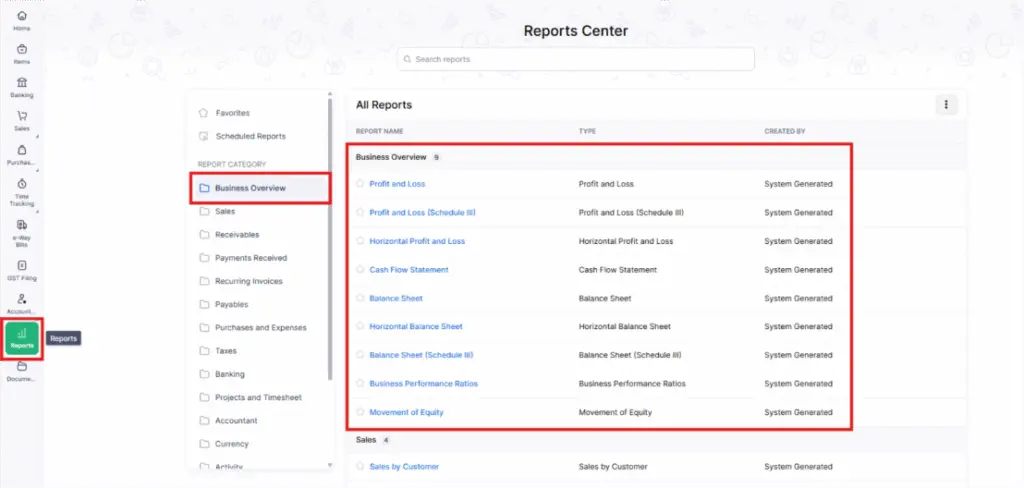

Step 1: Go to Reports on the left sidebar.

Step 2: Navigate to Business Overview reports and select the Profit and Loss report from the list.

Let us take a look at the different sections that this report contains

Operating Income

This is the total money received from all sales transactions between your business and its customers.

Cost of Goods Sold (COGS)

These are the expenses involved in purchasing or producing the products you sell to your customers.

Operating Expenses

These are the costs of running your business, like advertising, meals, travel, or vehicle-related expenses. In Zoho Books, if you’ve categorized expenses under an Expense account, they’ll show here.

Non-Operating Income/Expense

This includes income or losses from activities outside your core business operations. Examples include dividends received or losses from currency exchange.

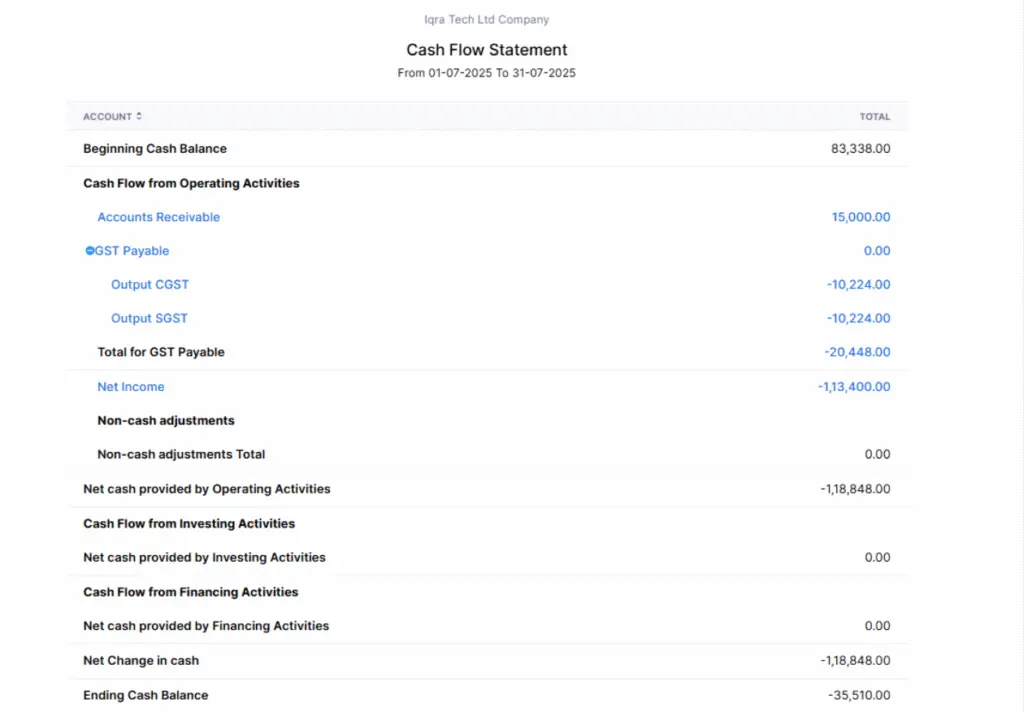

Cash Flow Statement

A Cash Flow Statement report is a financial document that provides a detailed overview of a company’s cash inflows and outflows over a specific period. It highlights how cash is generated and used in operating, investing, and financing activities, offering valuable insights into the company’s liquidity and financial health.

To view this report:

- Go to Reports on the left sidebar.

- Navigate to Business Overview reports and select the Cash Flow Statement report from the list.

Let us take a look at the different sections that this report contains:

Cash Flow from Operating Activities

The business activities carried out by an organization are called operating activities. Money generated from these activities is recorded under accounts such as Net Income, Accounts Receivable, and Inventory Asset.

Cash Flow from Investing Activities

As a business, you would look to invest in various assets for smooth functioning. Cash flow resulting from these activities will be displayed here. For example, this includes purchasing stationery and furniture for a new branch of your office.

Cash Flow from Financing Activities

Sometimes, you might want to raise funds for your organization or clear up any pending debts or loans. You can create transactions for any such activities in Zoho Books for them to reflect in your accounts

Net Change in cash

Total cash flow from operating, investing, and financing activities.

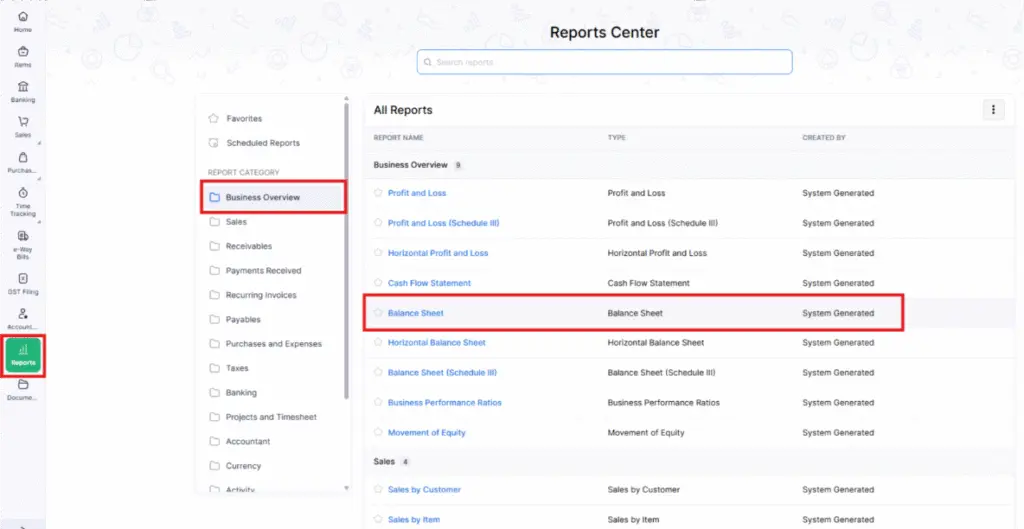

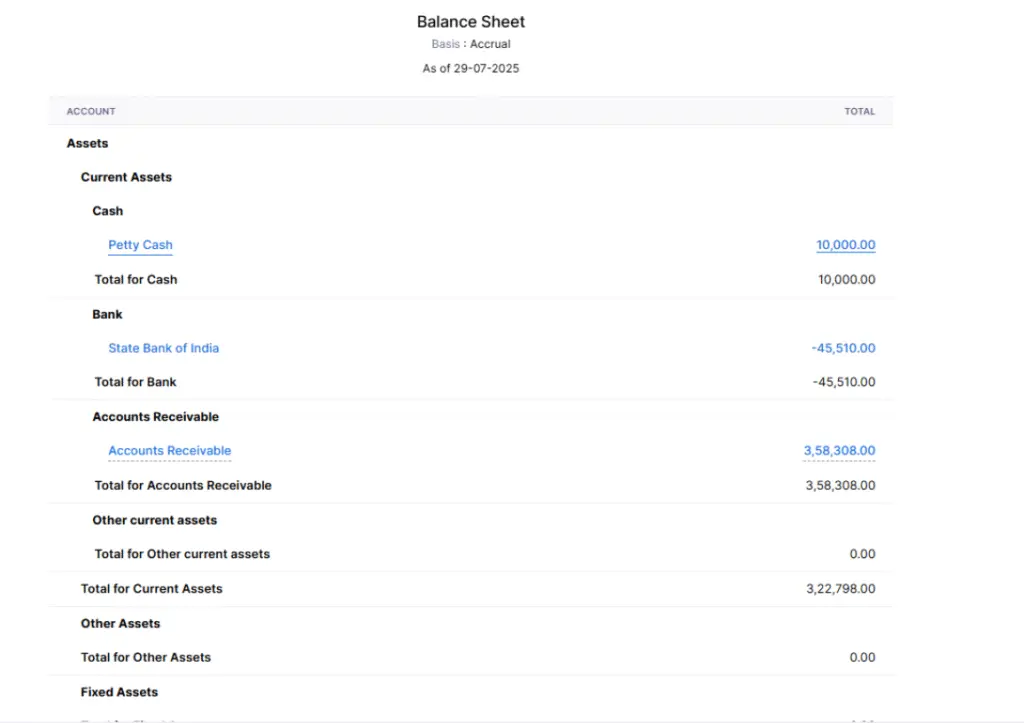

Balance Sheet

The balance sheet is a statement that summarizes the total amounts in all accounts, categorized into assets, liabilities, and equity in your organization.

To view this report:

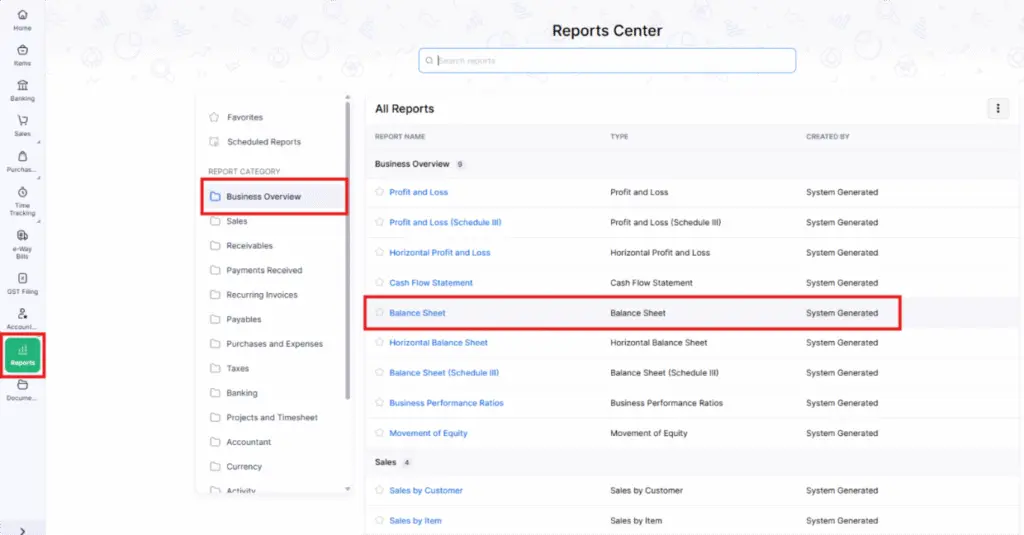

Step 1: Go to Reports on the left sidebar.

Step 2: Select the Balance Sheet report under the Business Overview section.

Let us take a look at the different accounts that this report contains:

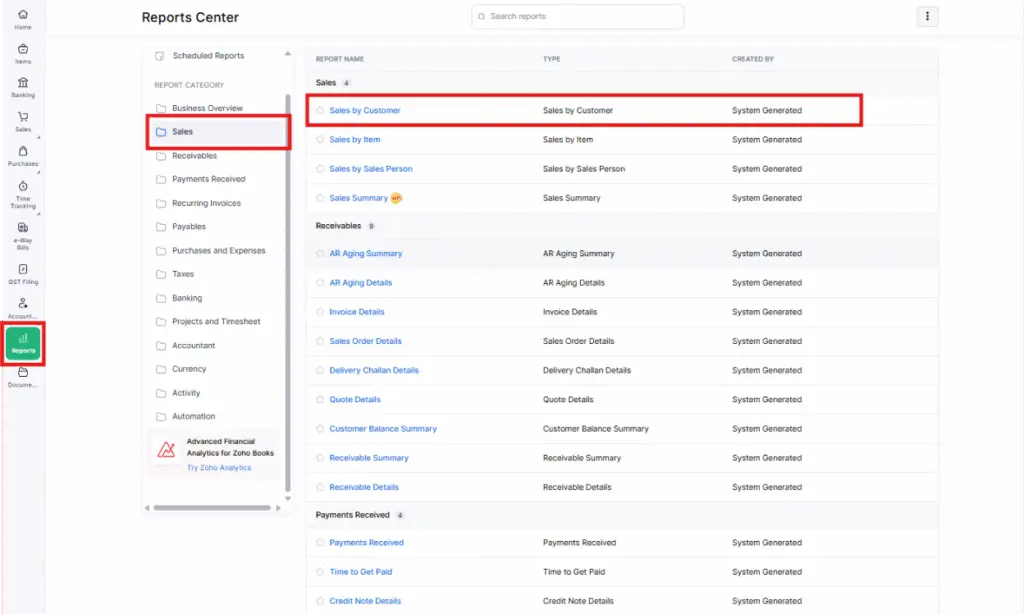

3. Sales

The sales section consists of three reports:

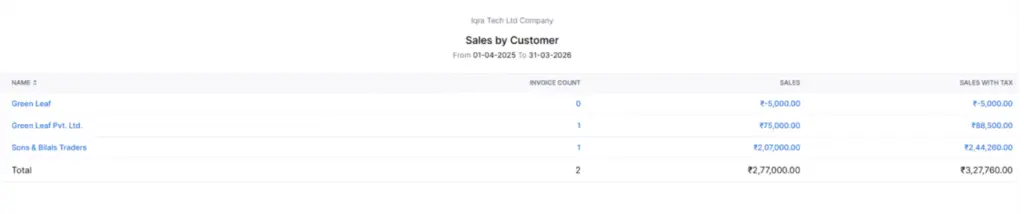

1. Sales by Customer

This report is a summary of all the invoices that you’ve created for the different customers in your organization. Invoices in the Draft status won’t be reflected here.

To view this report:

Step 1: Go to Reports on the left sidebar.

Step 2: Select the Sales by Customer report under the Sales section.

This report has the following category.

Name

The customer for whom you’ve created invoices period.

Invoice count

The total number of invoices which you’ve created for the customer.

Sales

The total of all the invoices created for the customer, exclusive of tax.

Sales with tax. The total amount on all the invoices for the customer, inclusive of tax.

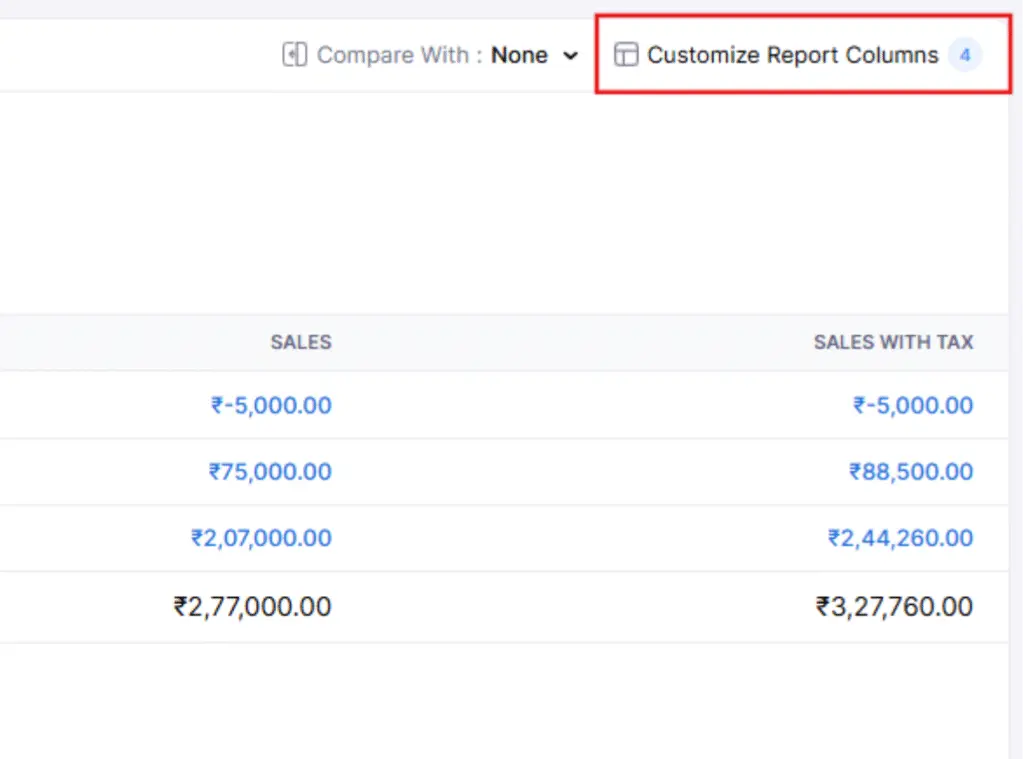

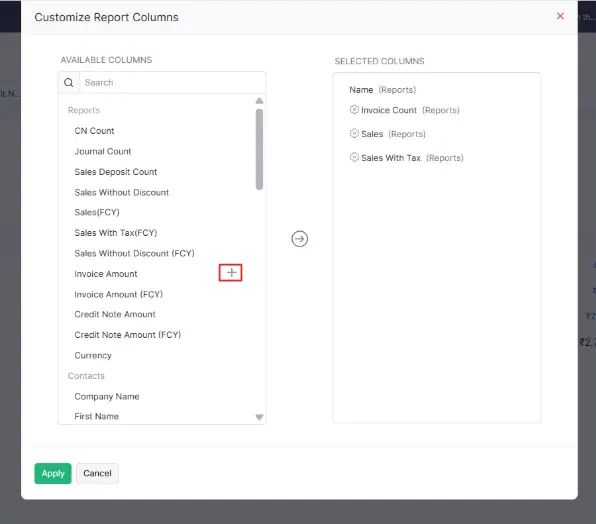

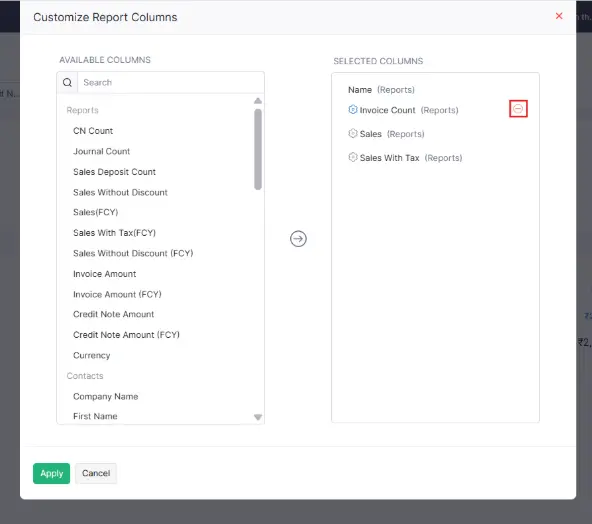

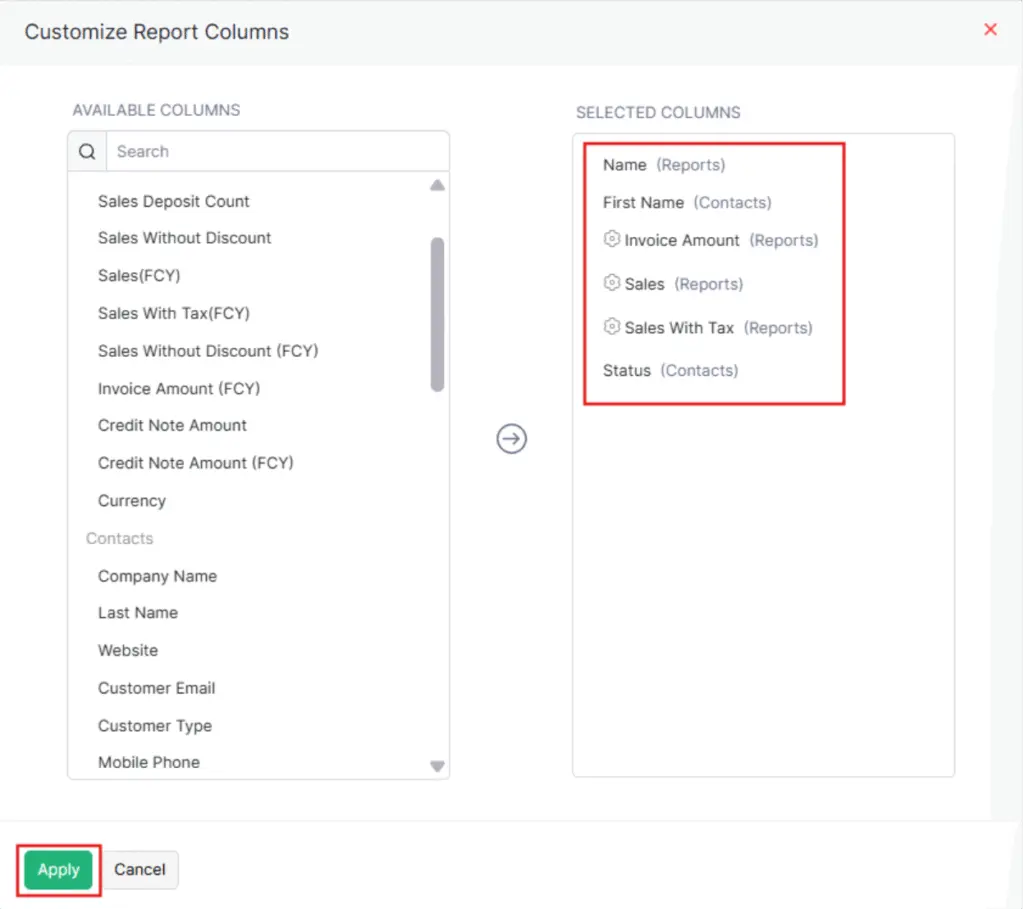

To customize this report:

Step 1: Go to Reports > Sales by Customer.

Step 2: Click Customize Report in the top of the page.

Note: You can see that I have customized some columns as an example, which you can refer to in the image above.

You can customize the report based on the following filters:

| Filters | Description |

|---|---|

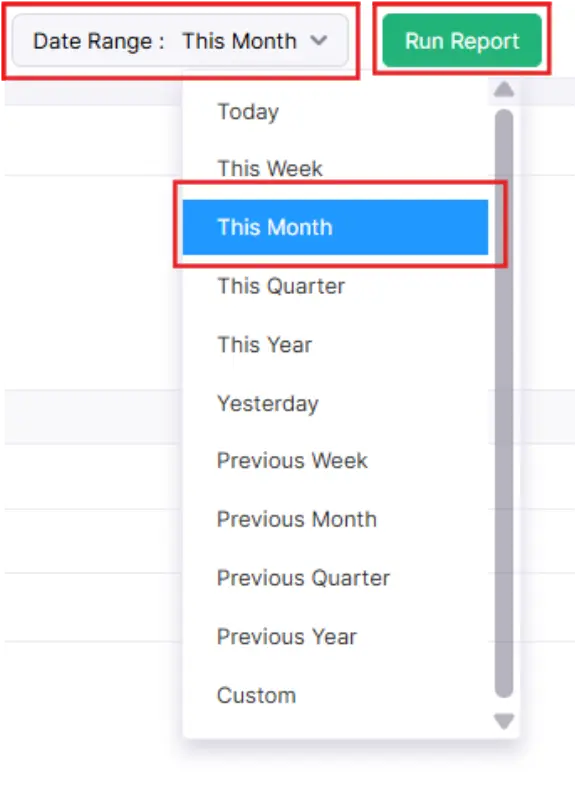

| Date Range | Select a predefined time period or define a custom date range for generating the report. |

| Sales Without Invoices & Sales Returns | Includes sales transactions recorded in Zoho Books that are not linked to invoices, such as customer bank transactions, along with sales returns. |

| Manual Journals | Displays any sales-related entries recorded in manual journals. |

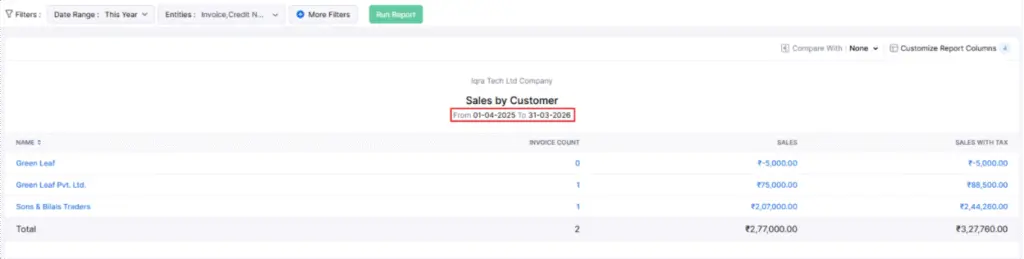

Click on Run Report.

Now you can see the report is generated after Run Report. According to our Date Range (I selected this Year).

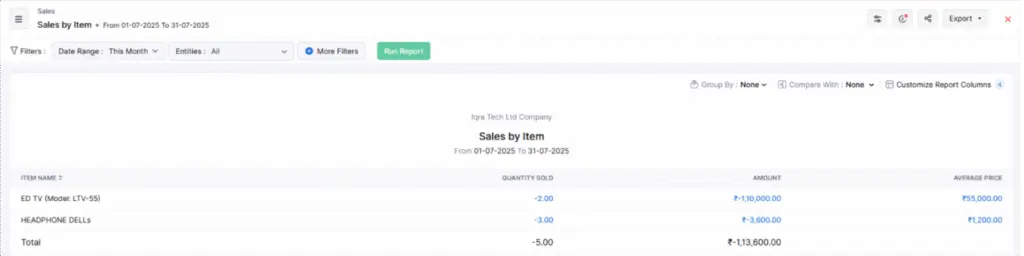

2. Sales by Item

This report is a summary of all the items which are sold in your organization and their average prices.

To view this report:

Step 1: Go to Reports on the left sidebar.

Step 2: Select the Sales by item report under the Sales section.

You enter in Sales by Item report.

3. Sales by Sales Person

This report is a summary of all the invoices and credit notes that different users and sales persons have created in your organization.

To view this report:

Step 1: Go to Reports on the left sidebar.

Step 2: Select the Sales by Sales Person report under the Sales section.

Click on any amount in the report to see a detailed breakdown of its summary.

This report is divided into the following sections:

INVOICE

Invoices by User

The “Others” section includes all invoices created by you or any other users within your organization. These invoices are not linked to any specific salesperson.

Invoices by Salesperson

Below the “Others” section, you will find a list of all invoices created by various salespeople in your organization.

The columns in this report are:

- Count: The total number of invoices.

- Sales: The sum of all invoices excluding tax.

- Sales with Tax: The total of all invoices including tax.

CREDIT NOTE

Credit Notes by User

The “Others” section shows all credit notes created by you or any other users in your organization. These credit notes are not associated with any specific salesperson.

Credit Notes by Salesperson

Below the “Others” section, you will see a list of all credit notes created by different salespeople in your organization.

The columns in this report are:

- Count: The total number of credit notes.

- Sales: The total value of all credit notes excluding tax.

- Sales with Tax: The total value of all credit notes including tax.

TOTAL

This section displays the overall sales value generated by the users and salespeople within your organization.

You can customize this report based on the period for which you want to generate it. To do so:

Step 1: Go to Reports on the left sidebar.

Step 2: Select the Sales by Sales Person report under the Sales section.

Step 3: Select the period for which you want to generate this report from the dropdown.